Are you wondering if you can use your credit card to pay your monthly car payment? Many people are exploring this option as a way to earn rewards, manage cash flow, or take advantage of credit card benefits. However, the answer isn't as straightforward as a simple "yes" or "no." This article will provide a comprehensive guide to help you understand the ins and outs of using a credit card for car payments.

In today's financial landscape, leveraging credit cards for various expenses has become increasingly common. Credit cards offer numerous benefits, such as cashback, travel rewards, and purchase protections. Paying your car loan with a credit card might seem like an attractive option, but it comes with certain considerations. We’ll explore everything you need to know to make an informed decision.

By the end of this article, you’ll have a clear understanding of whether using a credit card for your monthly car payment is a viable option for you. Let’s dive into the details!

Read also:What Is Sone385 A Comprehensive Guide To Its Features And Benefits

Table of Contents

- Introduction

- Why Use a Credit Card for Car Payments?

- How Does It Work?

- Credit Card Acceptance by Lenders

- Fees Involved in Using Credit Cards

- Advantages of Paying with a Credit Card

- Disadvantages of Paying with a Credit Card

- Alternatives to Credit Card Payments

- Expert Advice on Using Credit Cards

- Conclusion

Why Use a Credit Card for Car Payments?

Understanding the Motivation

Using a credit card to pay your monthly car payment can be appealing for several reasons. First, many credit cards offer rewards programs, such as cashback, travel miles, or points. By charging your car payment to your credit card, you can accumulate these rewards faster. Additionally, credit cards often provide purchase protection and extended warranties, which can be beneficial in case of disputes or unforeseen issues.

Another reason is cash flow management. If you prefer to delay paying your car loan until your credit card bill is due, using a credit card can give you extra time to manage your finances. However, it’s crucial to weigh the potential costs against the benefits.

How Does It Work?

The Mechanics of Credit Card Payments

When you decide to pay your car payment with a credit card, the process typically involves several steps:

- Check if your lender accepts credit card payments directly.

- If they don’t, consider using third-party services that facilitate credit card payments for car loans.

- Enter your credit card details into the lender’s payment portal or the third-party service platform.

- Review any fees associated with the transaction before confirming the payment.

It’s important to note that not all lenders allow direct credit card payments, and some may impose restrictions or additional charges.

Credit Card Acceptance by Lenders

Do All Lenders Allow Credit Card Payments?

Not all lenders accept credit card payments for car loans. Some lenders may offer this option as a convenience to their customers, while others may prohibit it altogether. If your lender doesn’t accept credit cards directly, you might still be able to use third-party payment processors, such as Plastiq or Paymentus. These services act as intermediaries, allowing you to pay your car loan with a credit card for a fee.

Before proceeding, always verify your lender’s policies regarding credit card payments to avoid any surprises.

Read also:Why Costco Doesnt Accept Mastercard A Comprehensive Guide

Fees Involved in Using Credit Cards

Understanding the Costs

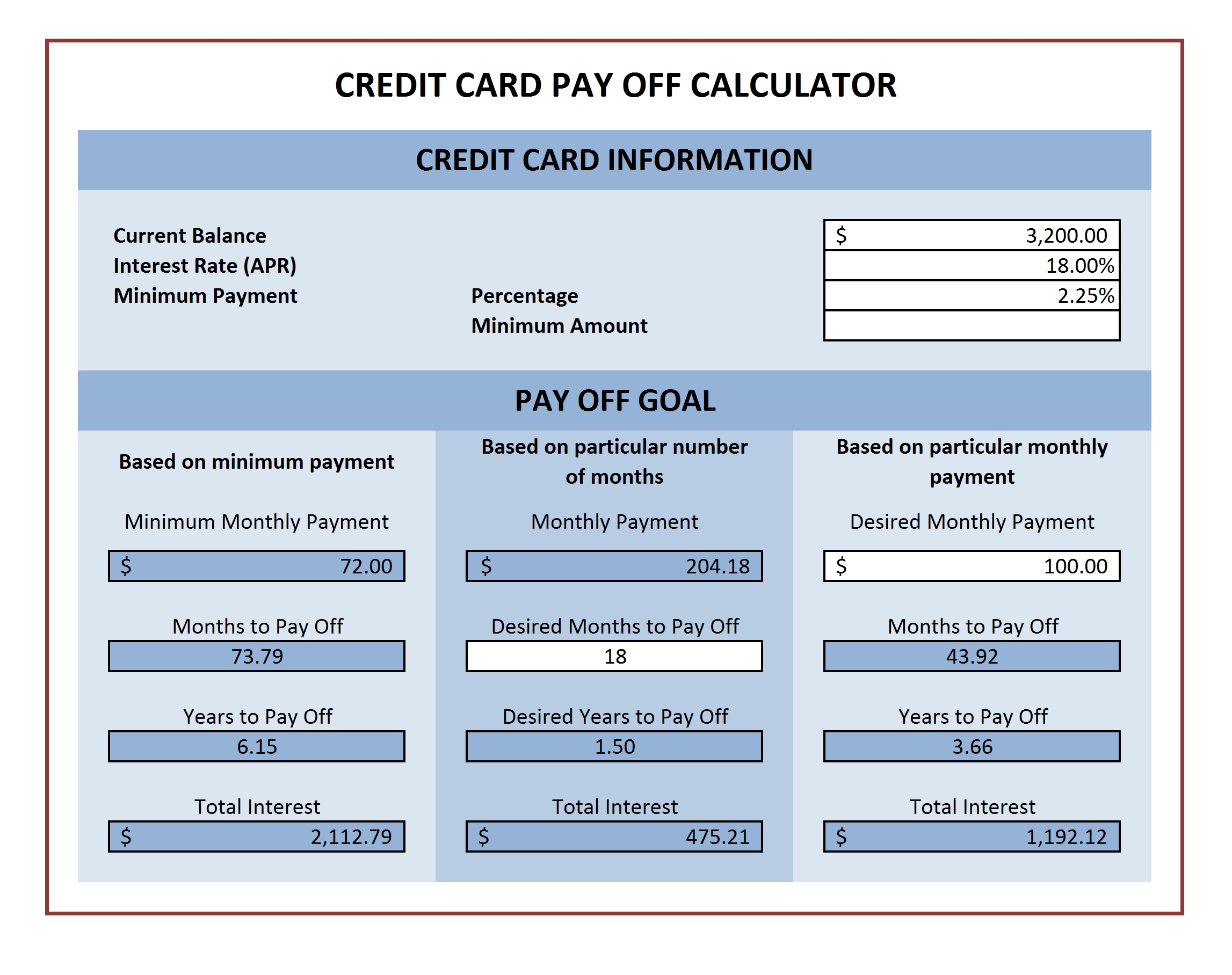

One of the primary concerns when using a credit card for car payments is the fees involved. Lenders or third-party services may charge processing fees, which can range from 2% to 5% of the payment amount. For example, if your monthly car payment is $500 and the fee is 3%, you would pay an additional $15 for the convenience.

Additionally, if you carry a balance on your credit card, you may incur interest charges. This could offset any rewards or benefits you gain from using the credit card. Always calculate the total cost before deciding to proceed.

Advantages of Paying with a Credit Card

What Are the Benefits?

Paying your car payment with a credit card offers several advantages:

- Rewards Accumulation: Earn cashback, travel miles, or points by charging your car payment to your credit card.

- Purchase Protection: Credit cards often provide additional protections, such as dispute resolution and extended warranties.

- Cash Flow Management: Delay the payment until your credit card bill is due, giving you more time to manage your finances.

- Convenience: Simplify the payment process by using a single credit card for multiple expenses.

However, these benefits should be weighed against the potential drawbacks, such as fees and interest charges.

Disadvantages of Paying with a Credit Card

What Are the Drawbacks?

While using a credit card for car payments has its advantages, there are also some disadvantages to consider:

- Processing Fees: Lenders or third-party services may charge significant fees for credit card payments.

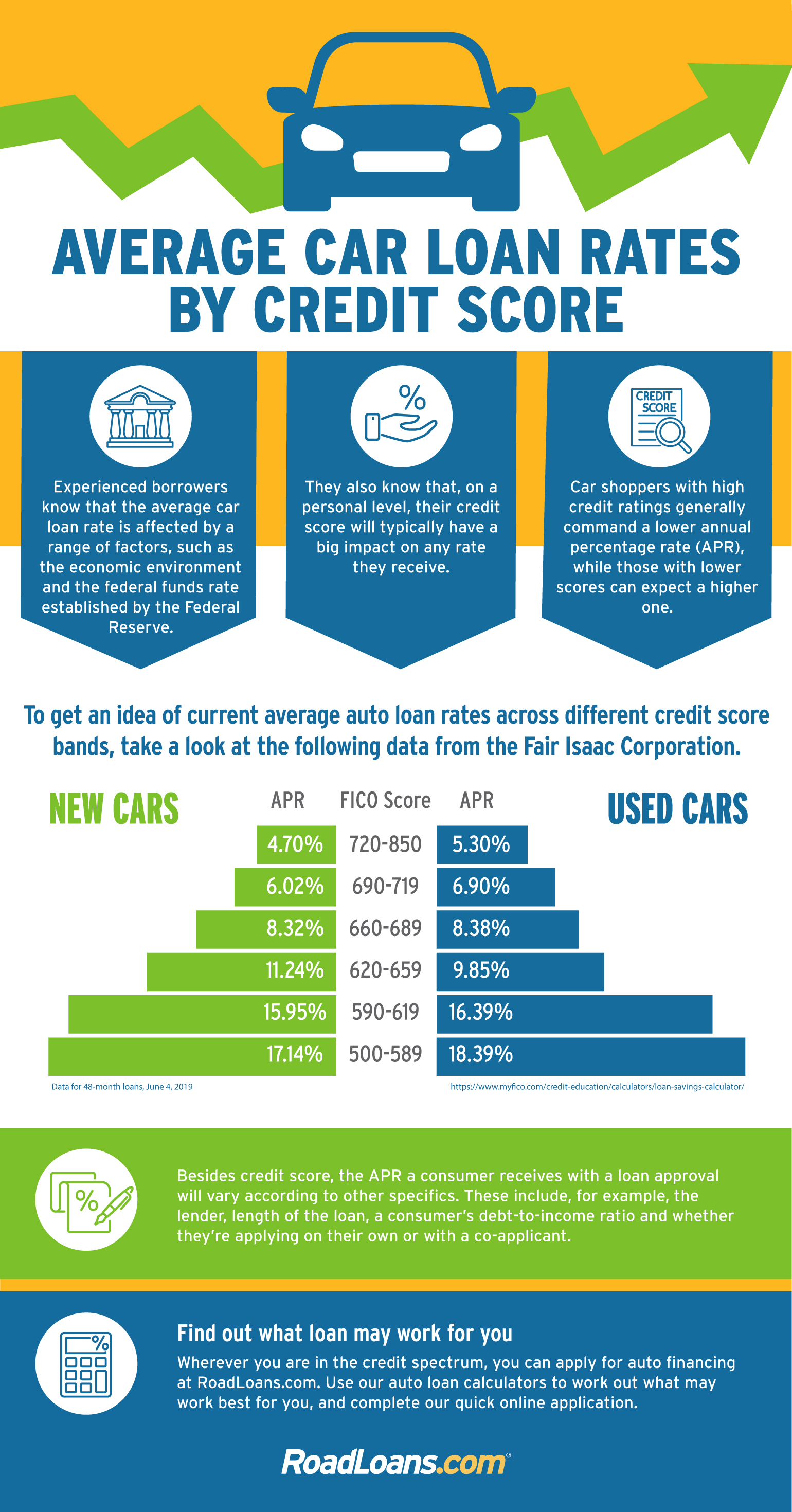

- Interest Charges: If you don’t pay your credit card balance in full each month, you may incur interest charges, which can add to the cost of your car loan.

- Credit Utilization: Charging large payments to your credit card can increase your credit utilization ratio, potentially affecting your credit score.

- Limitations: Not all lenders accept credit card payments, and some may impose restrictions or caps on the amount you can charge.

It’s essential to carefully evaluate these drawbacks before deciding to use a credit card for your car payment.

Alternatives to Credit Card Payments

Exploring Other Options

If using a credit card for your car payment isn’t feasible or desirable, there are other options to consider:

- Bank Transfers: Set up automatic bank transfers to ensure timely payments without incurring additional fees.

- Debit Cards: Use a debit card to avoid interest charges while still earning rewards in some cases.

- Personal Loans: Consider refinancing your car loan with a personal loan that offers lower interest rates.

- Payment Plans: Negotiate a payment plan with your lender to better manage your monthly expenses.

Each alternative has its own set of pros and cons, so it’s important to choose the option that best fits your financial situation.

Expert Advice on Using Credit Cards

What Do Financial Experts Say?

Financial experts generally advise caution when using credit cards for car payments. While the rewards and convenience can be appealing, the potential costs, such as fees and interest charges, may outweigh the benefits. Here are some expert tips:

- Calculate the Total Cost: Before proceeding, calculate the total cost of using a credit card, including fees and interest charges.

- Prioritize Rewards: If you have a credit card with a high rewards program, it may be worth using it for your car payment, as long as you pay off the balance in full each month.

- Monitor Your Credit Utilization: Keep an eye on your credit utilization ratio to ensure it doesn’t negatively impact your credit score.

- Explore Other Options: Consider alternative payment methods, such as bank transfers or debit cards, if they better suit your financial needs.

By following these tips, you can make an informed decision about whether using a credit card for your car payment is the right choice for you.

Conclusion

In conclusion, paying your monthly car payment with a credit card can be a viable option if used wisely. The ability to earn rewards, manage cash flow, and access purchase protections are compelling reasons to consider this approach. However, it’s important to weigh the potential costs, such as fees and interest charges, against the benefits.

Before proceeding, verify your lender’s policies regarding credit card payments and explore alternative options if necessary. Always calculate the total cost and monitor your credit utilization to maintain a healthy financial profile.

We encourage you to leave a comment below sharing your thoughts or experiences with using credit cards for car payments. If you found this article helpful, please share it with others who might benefit from the information. For more financial tips and advice, explore our other articles on managing debt, building credit, and achieving financial freedom.