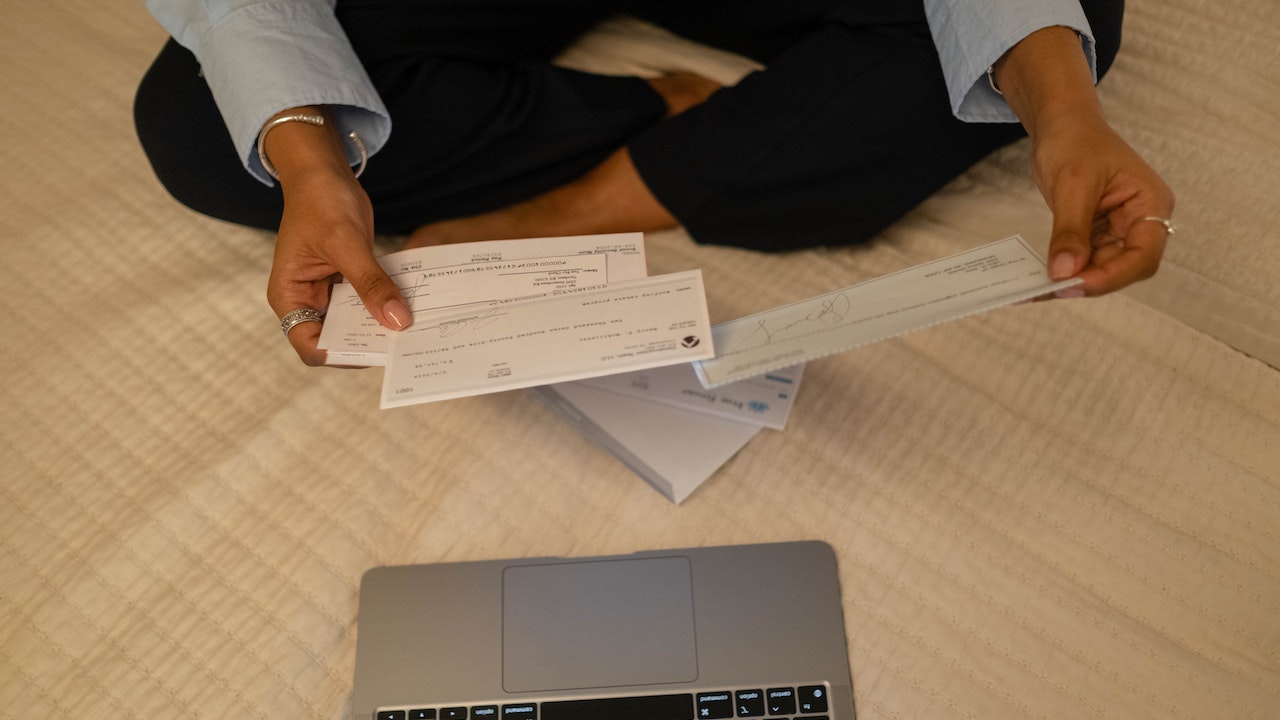

Cashing a check without ID may seem challenging, but it is possible with the right strategies. Many people find themselves in situations where they need to cash checks but don’t have proper identification. This article will guide you through the process and provide practical solutions to help you achieve this goal safely and legally.

Whether you’ve misplaced your ID or never had one, there are alternative methods to cash a check. Understanding the options available to you can save time and reduce stress. From leveraging trusted financial institutions to exploring alternative services, this guide covers everything you need to know.

This article is designed to help you navigate the complexities of cashing checks without ID while ensuring compliance with legal and financial regulations. Let’s dive into the details and explore how you can make this process seamless.

Read also:Unblocked Games 66 The Ultimate Guide To Fun And Safe Gaming

Table of Contents

- Introduction

- Why People Need to Cash Checks Without ID

- Legal Considerations When Cashing Checks Without ID

- Methods to Cash a Check Without ID

- Bank Options for Cashing Checks Without ID

- Check Cashing Stores Without ID

- Online Options for Cashing Checks Without ID

- Using Prepaid Cards to Cash Checks

- Tips for Successfully Cashing Checks Without ID

- Common Questions About Cashing Checks Without ID

- Conclusion

Why People Need to Cash Checks Without ID

Many individuals find themselves in situations where they need to cash checks but lack proper identification. This can happen due to various reasons, such as losing an ID, not having access to one, or being undocumented. In some cases, people may not want to use their ID for privacy or security reasons.

Regardless of the reason, the need to cash checks without ID is real. According to the Federal Reserve, over 6% of households in the United States are unbanked or underbanked, meaning they don’t have access to traditional banking services. This makes alternative methods of cashing checks essential for many people.

Key reasons why individuals seek ways to cash checks without ID:

- Lost or stolen identification

- Undocumented status

- Privacy concerns

- Limited access to banking services

- Financial constraints

Legal Considerations When Cashing Checks Without ID

Before exploring the methods to cash a check without ID, it’s important to understand the legal implications. Financial institutions and check-cashing services are required by law to verify the identity of individuals cashing checks. This is part of anti-money laundering regulations designed to prevent fraud and illegal activities.

However, there are legal ways to cash checks without ID, especially if you can provide alternative forms of identification or use trusted services. Always ensure that the methods you choose comply with local and federal laws.

Understanding Anti-Money Laundering (AML) Regulations

Anti-Money Laundering (AML) regulations require financial institutions to verify the identity of individuals conducting transactions. While this can make it challenging to cash checks without ID, there are ways to work within these regulations. For example, some banks allow account holders to cash checks without ID if they have a verified account.

Read also:Visiter Le Japon Deacutecouvrez La Magie De Lrsquoorient

Methods to Cash a Check Without ID

There are several methods you can use to cash a check without ID. Each method has its own advantages and limitations, so it’s important to choose the one that best suits your needs. Below are some of the most effective methods:

1. Cashing Checks at the Bank of the Check Issuer

One of the most reliable ways to cash a check without ID is to visit the bank where the check was issued. As long as the check is drawn on a specific bank, you can go to that bank and request to cash it. The bank may require you to endorse the check, but they are more likely to accept it without ID if it’s from their own institution.

2. Using a Prepaid Debit Card

Prepaid debit cards are a convenient alternative for cashing checks without ID. You can deposit checks directly onto the card using mobile check deposit services. Some prepaid cards even allow you to cash checks in person at authorized locations.

3. Exploring Alternative Check-Cashing Services

Some check-cashing stores offer services for individuals without ID. While these services may charge higher fees, they can be a viable option if you need to cash a check quickly. Always research the reputation of the service provider before using their services.

Bank Options for Cashing Checks Without ID

Many banks offer services for individuals without ID, especially if they have a verified account. Below are some bank options you can consider:

1. Wells Fargo

Wells Fargo allows account holders to cash checks without ID if they have a verified account. Non-account holders may also be able to cash checks at Wells Fargo branches, but they may need to provide alternative forms of identification.

2. Chase Bank

Chase Bank offers similar services for account holders. If you have a verified account, you can cash checks without ID. Non-account holders may face stricter requirements, but Chase is known for its flexibility in certain situations.

Check Cashing Stores Without ID

Check-cashing stores are another option for individuals without ID. While these services may charge higher fees, they can be a convenient solution in emergencies. Below are some check-cashing stores that accept alternative forms of identification:

1. ACE Cash Express

ACE Cash Express is a popular check-cashing service that accepts alternative forms of identification. They offer competitive rates and are known for their customer service. However, it’s important to verify their policies before visiting a location.

2. Check ‘n Go

Check ‘n Go is another reputable check-cashing service that may allow you to cash checks without ID. They offer flexible options and are widely available in many states. Always check their specific requirements for your location.

Online Options for Cashing Checks Without ID

With the rise of digital banking, there are now online options for cashing checks without ID. Below are some platforms you can consider:

1. PayPal

PayPal allows users to deposit checks using their mobile app. While you may need to verify your account, PayPal offers a secure and convenient way to cash checks without visiting a physical location. Simply endorse the check and use the app to deposit it.

2. Venmo

Similar to PayPal, Venmo offers a mobile check deposit feature. You can deposit checks directly into your Venmo account and transfer the funds to your bank account or prepaid card. Venmo is a popular choice for its user-friendly interface and security features.

Using Prepaid Cards to Cash Checks

Prepaid cards are becoming increasingly popular for cashing checks without ID. These cards allow you to deposit checks directly onto the card and access the funds instantly. Below are some prepaid card options:

1. Green Dot Card

The Green Dot Card is one of the most widely used prepaid cards for cashing checks. It offers mobile check deposit services and allows you to cash checks at authorized locations. The card is reloadable and provides a convenient way to manage your finances.

2. NetSpend Card

NetSpend offers a range of prepaid card options for cashing checks. Their cards are accepted at thousands of locations nationwide and provide a secure way to access your funds. NetSpend also offers mobile check deposit services for added convenience.

Tips for Successfully Cashing Checks Without ID

To ensure a smooth experience when cashing checks without ID, follow these tips:

- Research the policies of the bank or check-cashing service beforehand.

- Endorse the check before presenting it for cashing.

- Provide alternative forms of identification if possible, such as utility bills or letters of reference.

- Consider opening a prepaid card account for easier access to check-cashing services.

- Be prepared to pay fees for check-cashing services.

Common Questions About Cashing Checks Without ID

1. Can I cash a check without ID at any bank?

While not all banks allow you to cash checks without ID, some do offer this service to account holders. It’s important to verify the policies of the specific bank you plan to visit.

2. Are there any risks involved in cashing checks without ID?

There are minimal risks involved if you use legitimate services. However, always be cautious of scams and ensure that the check is legitimate before attempting to cash it.

3. What forms of alternative identification are accepted?

Alternative forms of identification may include utility bills, letters of reference, or other documents that prove your identity. Always check with the service provider for their specific requirements.

Conclusion

Cashing a check without ID is possible with the right strategies and resources. By exploring bank options, check-cashing stores, and online platforms, you can find a solution that works for you. Remember to always verify the policies of the service provider and provide alternative forms of identification if possible.

We encourage you to share this article with others who may find it helpful. If you have any questions or comments, feel free to leave them below. Together, we can make financial transactions more accessible for everyone.

For more information on financial topics, explore our other articles and resources. Stay informed and empowered in your financial journey!