Due diligence in private equity plays a pivotal role in ensuring that investments are secure, profitable, and aligned with long-term goals. It is the process through which investors thoroughly evaluate a target company before committing substantial capital. This critical step can mean the difference between a successful investment and a costly mistake.

Private equity firms rely on robust due diligence processes to mitigate risks, uncover hidden liabilities, and identify opportunities for value creation. By examining financial statements, market positioning, legal compliance, and operational efficiency, investors can make informed decisions that maximize returns while minimizing risks.

In this article, we will explore the intricacies of due diligence in private equity, providing actionable insights and expert guidance. Whether you're a seasoned investor or a newcomer to the world of private equity, this guide will equip you with the knowledge needed to navigate this complex yet rewarding landscape.

Read also:Unlocking Success With Masa49mba Your Ultimate Guide To Growth And Opportunities

Table of Contents

- What is Due Diligence in Private Equity?

- The Importance of Due Diligence in Private Equity

- Types of Due Diligence in Private Equity

- Financial Due Diligence: Analyzing Financial Health

- Legal Due Diligence: Ensuring Compliance and Mitigating Risks

- Operational Due Diligence: Evaluating Business Processes

- Market Due Diligence: Assessing Market Position and Growth Potential

- Human Capital Due Diligence: Understanding Workforce Dynamics

- Environmental Due Diligence: Identifying Sustainability Risks

- Common Challenges in Private Equity Due Diligence

- Best Practices for Conducting Effective Due Diligence

- Conclusion: Unlocking Success Through Due Diligence

What is Due Diligence in Private Equity?

Due diligence in private equity refers to the comprehensive evaluation process conducted by investors to assess the viability and potential of a target company before making an investment decision. This process involves gathering and analyzing a wide range of data, including financial records, legal documents, operational processes, and market conditions.

The primary objective of due diligence is to uncover any risks, liabilities, or issues that may impact the success of the investment. By thoroughly examining the target company, investors can gain a deeper understanding of its strengths, weaknesses, and opportunities for growth. This knowledge enables them to negotiate favorable terms, structure deals effectively, and create value post-acquisition.

The Due Diligence Process

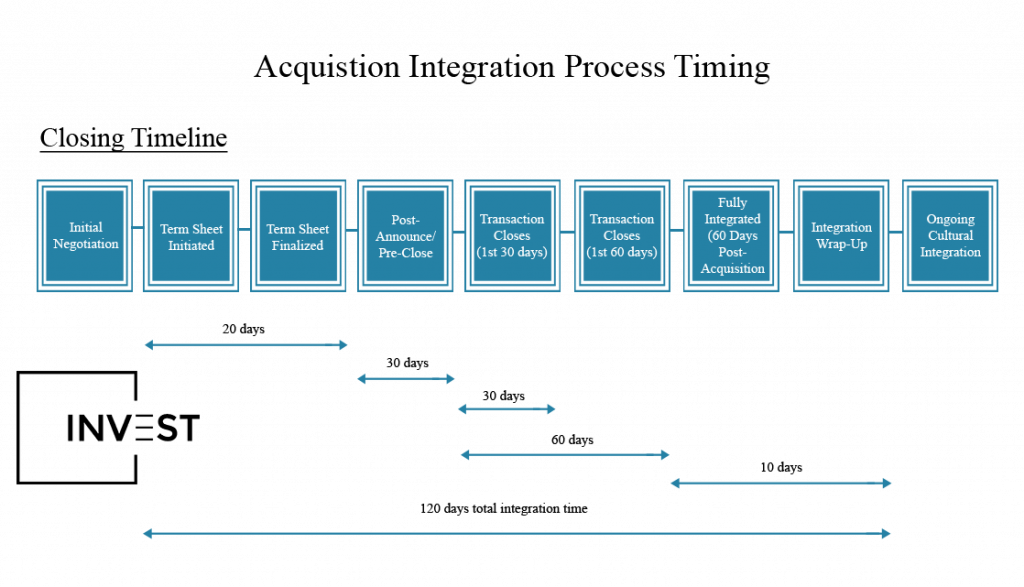

Conducting due diligence in private equity typically involves several stages:

- Preparation: Defining the scope of the due diligence process and assembling a team of experts.

- Data Collection: Gathering relevant information from the target company and external sources.

- Analysis: Evaluating the collected data to identify key insights and potential risks.

- Reporting: Compiling findings into a detailed report that informs investment decisions.

The Importance of Due Diligence in Private Equity

Due diligence is an essential component of the private equity investment process. Without it, investors risk making decisions based on incomplete or inaccurate information, which can lead to significant financial losses. By conducting thorough due diligence, investors can:

- Minimize risks by identifying potential issues early in the process.

- Enhance deal negotiation by leveraging insights gained during due diligence.

- Maximize returns by uncovering opportunities for value creation.

- Ensure compliance with legal and regulatory requirements.

A study by McKinsey & Company found that companies that conducted rigorous due diligence were more likely to achieve their investment objectives and generate higher returns compared to those that skipped this critical step.

Types of Due Diligence in Private Equity

Due diligence in private equity encompasses various types, each focusing on a specific aspect of the target company. Understanding these types is crucial for conducting a holistic evaluation.

Read also:Barbara Cooper The Inspiring Journey Of A Talented Actress

Financial Due Diligence: Analyzing Financial Health

Financial due diligence involves examining the target company's financial statements, cash flow, and overall financial health. This process helps investors assess the company's profitability, liquidity, and solvency. Key areas of focus include:

- Revenue and expense analysis.

- Balance sheet review.

- Cash flow projections.

Data from financial due diligence can reveal trends, anomalies, and areas of concern that may impact the investment's success.

Legal Due Diligence: Ensuring Compliance and Mitigating Risks

Legal due diligence focuses on verifying the target company's compliance with laws and regulations. This includes reviewing contracts, intellectual property rights, litigation history, and employment agreements. By ensuring legal compliance, investors can avoid costly disputes and penalties down the line.

Operational Due Diligence: Evaluating Business Processes

Operational due diligence examines the target company's operational efficiency and effectiveness. This process involves assessing supply chain management, production processes, and quality control systems. By identifying operational strengths and weaknesses, investors can develop strategies to enhance performance post-acquisition.

Market Due Diligence: Assessing Market Position and Growth Potential

Market due diligence involves analyzing the target company's market position, competitive landscape, and growth opportunities. This includes evaluating market size, customer demographics, and industry trends. By understanding the market dynamics, investors can determine the company's potential for long-term success.

Key Aspects of Market Analysis

Conducting market due diligence requires a thorough examination of the following factors:

- Market size and growth rate.

- Customer acquisition and retention strategies.

- Competitor analysis and market share.

Human Capital Due Diligence: Understanding Workforce Dynamics

Human capital due diligence focuses on evaluating the target company's workforce and organizational culture. This process involves assessing employee skills, leadership capabilities, and talent retention strategies. By understanding the human capital dynamics, investors can identify opportunities to enhance productivity and morale.

Employee Evaluation and Retention

Key areas of focus in human capital due diligence include:

- Employee skill assessment and training programs.

- Leadership effectiveness and succession planning.

- Employee satisfaction and retention strategies.

Environmental Due Diligence: Identifying Sustainability Risks

Environmental due diligence involves assessing the target company's environmental impact and sustainability practices. This process helps investors identify potential risks related to climate change, resource scarcity, and regulatory compliance. By addressing these risks, investors can ensure long-term viability and align with global sustainability goals.

Sustainability Practices and Compliance

Key aspects of environmental due diligence include:

- Carbon footprint analysis and reduction strategies.

- Compliance with environmental regulations.

- Resource management and waste reduction initiatives.

Common Challenges in Private Equity Due Diligence

While due diligence is a powerful tool, it is not without its challenges. Some common obstacles include:

- Limited access to information from the target company.

- Time constraints and pressure to complete the process quickly.

- Difficulty in identifying hidden liabilities or risks.

Overcoming these challenges requires a well-structured approach, experienced professionals, and the use of advanced analytics tools.

Best Practices for Conducting Effective Due Diligence

To ensure the success of due diligence in private equity, investors should adopt the following best practices:

- Assemble a multidisciplinary team of experts, including financial analysts, legal advisors, and industry specialists.

- Define clear objectives and priorities for the due diligence process.

- Utilize technology and data analytics to enhance efficiency and accuracy.

- Document findings thoroughly and present them in a clear, actionable format.

Conclusion: Unlocking Success Through Due Diligence

Due diligence in private equity is a critical component of the investment process that can significantly impact the success of deals. By conducting thorough evaluations of financial, legal, operational, market, and human capital factors, investors can minimize risks, maximize returns, and create long-term value.

We invite you to share your thoughts and experiences with due diligence in private equity by leaving a comment below. Additionally, feel free to explore other articles on our site for more insights into the world of private equity and investment strategies. Together, let's unlock the potential for success in this dynamic field.